1098

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 30 Jan 2024

1098 points (98.5% liked)

Technology

60112 readers

3870 users here now

This is a most excellent place for technology news and articles.

Our Rules

- Follow the lemmy.world rules.

- Only tech related content.

- Be excellent to each another!

- Mod approved content bots can post up to 10 articles per day.

- Threads asking for personal tech support may be deleted.

- Politics threads may be removed.

- No memes allowed as posts, OK to post as comments.

- Only approved bots from the list below, to ask if your bot can be added please contact us.

- Check for duplicates before posting, duplicates may be removed

Approved Bots

founded 2 years ago

MODERATORS

A better idea is to go to irs.gov and use their free file wizard to see which service is free for you. I used 1040.com this year. Last year I used freetaxusa.com, but this year that would not have been free for me due to my change in income. Which service is free depends on your state, income, and income complexity.

My problem with IRS.gov is they have a history of sending users to sites owned by Intuit. These sites would claim to be free, but would then trick the user into a paid pathway and guide them to an expensive paid checkout. I haven't been back to IRS.gov since experiencing that.

I learned later that Intuit (who owns Turbotax) had spent millions lobbying to get that to happen. Since the IRS can be lobbied by corporations to trick users like that, I just don't trust IRS.gov to be honest.

Intuit recently got slapped by a different government agency. I doubt that they will get that privelage again for a while.

TurboTax discontinued their participation in the IRS Free File program a few years back, IIRC. I don't think they'll be listed on the IRS's Free File website.

Corporations are able to buy their way into an IRS endorsement. There is no reason to trust their links just because a singularly egregious deception has been removed from their site.

The IRS presented them to the public as a "free option" for years, knowing they were not free. The IRS lied for profit. I have no reason at all to ever trust their suggestions.

It would be unreasonable for me to return to the same entity that lied to me and ask for more advice.

The only time they're not free is if you don't meet the requirements for the Free File Program or you try to use one of TurboTax's services that aren't part of the Free File Program.

I actually used TurboTax for years before they left the Free File Program (supposedly because it was too restrictive in what they could charge for), and I never had to pay a cent. I've since moved on to other tax sites that are still part of the Free File Program, and I've still never had to pay anything.

Most people who tried to use the program were deceived by Intuit. Intuit settled numerous lawsuits for their lies. Their expensive settlement is why Intuit left the program. Here's a relevant exerpt from an Ars Technica article on the topic:

I would argue that the IRS wasn't at fault here, though. Like the article said, people were steered away from the Free File Program, so people having to pay wasn't a fault of the Free File Program but rather a fault of Intuit's deceptive practices of marketing their alternative freemium versions of their software.

The IRS was very aware of it as it had been going on for years. There were numerous complaints and lawsuits that the IRS were made aware of as they happened.

Intuit spent millions annually lobbying anyone who would accept their money and were permitted to remain part of the free-file program for years with their famously deceptive software.

The IRS and lawmakers have all been complicit in allowing this to happen for an extended period of time.

Just curious, why are you defending Intuit or the IRS? It seems an odd position to take. I've never encountered someone with this position before.

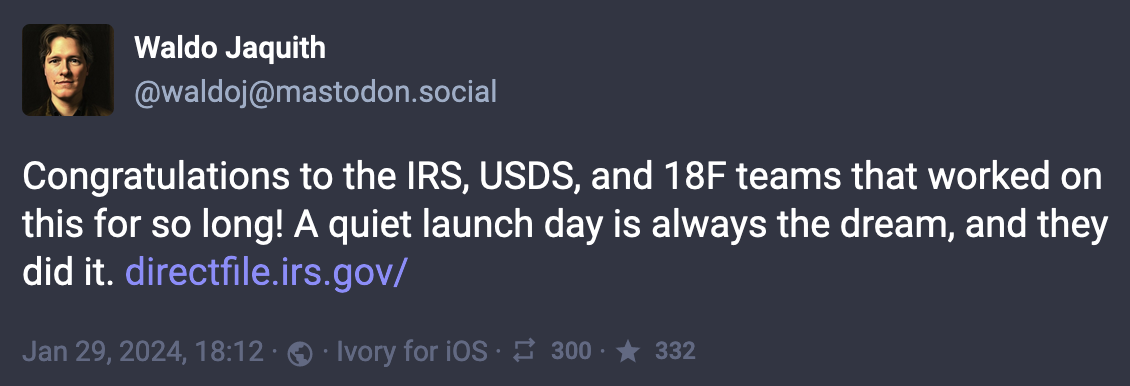

Nice, here’s that link.

Check out Tax Hawk, it might be a good option for you this year