382

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 21 Sep 2023

382 points (94.6% liked)

Socialism

5294 readers

59 users here now

Rules TBD.

founded 5 years ago

MODERATORS

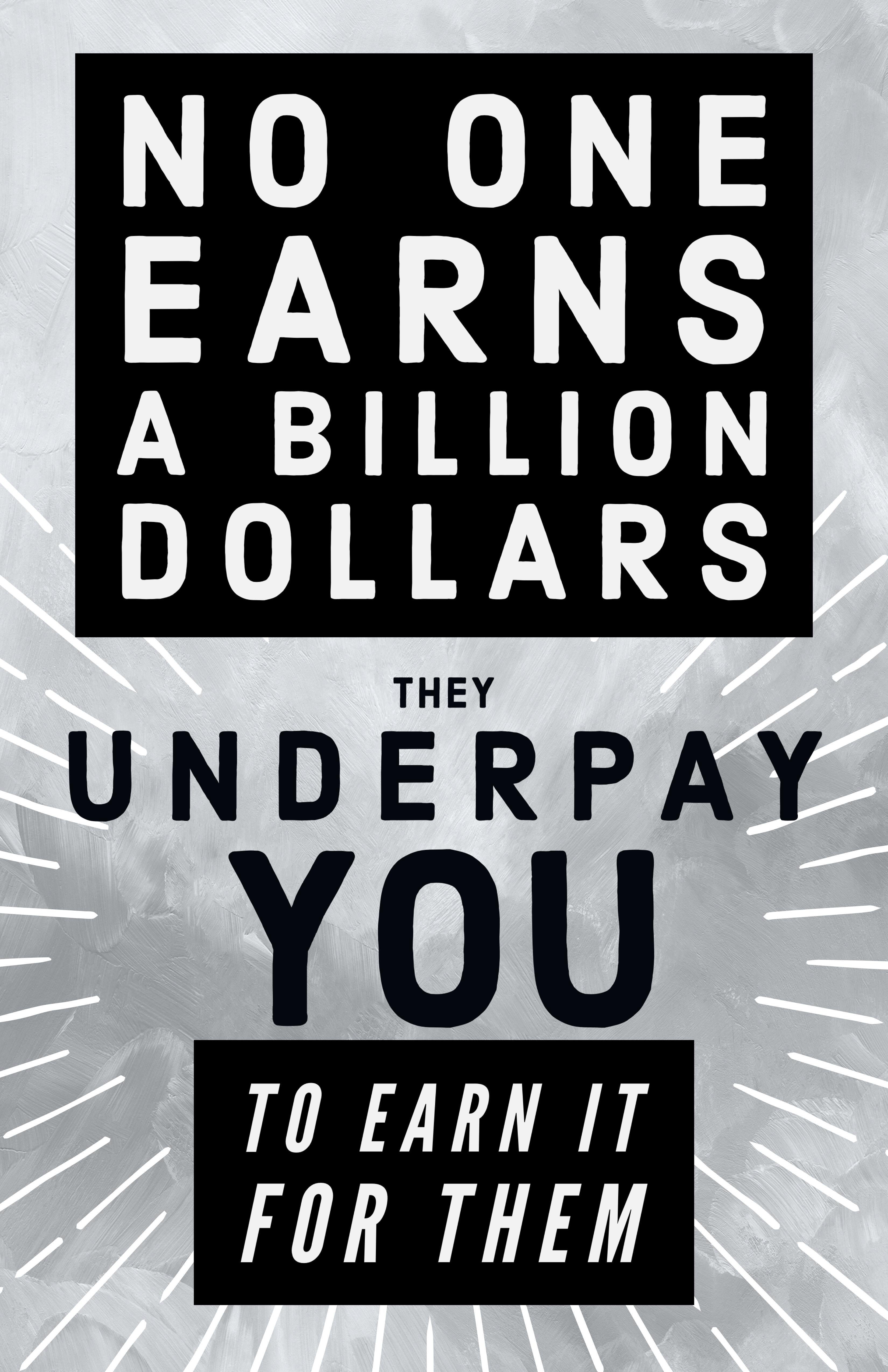

Point taken, but FYI billionaires don't "earn" a billion dollars regardless, it's almost exclusively because their net worth due to stock ownership makes them a billionaire.

If you bought a house somewhere cheap, and then the eyesore old factory down the road gets torn down, and the land around your house explodes in value, you did not make a million dollars in income, even though your house is now worth that much.

As well, most billionaires live off money they borrow at stupid low interest rates because that doesn't count as income. An accountant would be able to explain in depth but that's one of the way they dodge taxes.

Ya know, workers can own stocks too. There's even companies that give stocks to employees. Stocks themselves are not the problem.

Workers may hold stocks, but anyone who holds a sufficient value of stocks is by virtue of such holdings not a worker. Therefore, stocks support the stratification of society into workers, who may hold stocks but remain workers, and owners, whose ownership of stocks is sufficient that they are not workers.

Stocks are just an abstracted way of exploiting workers.

No they are a way of sharing ownership in a company. It is the speculation that occurs in stock exchanges than can lead to negative outcomes for employees.

Speculation has been a relatively insignificant factor overall in the trade of stocks compared to growth in their intrinsic value.

Stocks carry and accrue value due to the work of others than those who hold them.

That simply is not true. The value of publicly traded stocks is based upon the speculation that the value of the stock will rise or decline which is often not related to the productivity of the workers.

The notion that all value cones from labor is fundamentally incorrect. Value can be created by scarcity and speculation which has been demonstrated time and again. For example all those recent finds of lithium potential mines have impacted the price of lithium world wide despite not a single mine being approved or any work being done to obtain it. Just knowing it is there has created that change.

All theories of value are lacking in one way or another, but you're definitely in the wrong community if you fundamentally disagree with the labor theory of value. Intrinsically, an item has value based on demand and usefulness. However, no items exist without labor. The value of an item is disconnected from the wage exchanged to create it, and this theft of value is what we call "profit".

Speculation depends on a belief that value will rise in the future, which depends on, except in a few extreme cases of investors being scammed, the recognition of other value not speculative.

Land speculators know that land has usefulness, for development, agriculture, or resources. Stock speculators know that stocks have value generated by work. Even if market value has some component that is speculative, always some component is due to intrinsic value.

Your assertion, that "value of publicly traded stocks is based upon the speculation that the value of the stock will rise or decline", is refuted by the contradictions it itself implies.

An asset class whose value is purely speculative necessarily will collapse eventually. Generally in such cases the speculative value is generated through hype created by a nefarious actor who originally created the asset. Such is the nature of Ponzi schemes.

You seem to be confused by my comment if you think it is contradictory.

I think APPL is overvalued so Im selling its stock while someone else believes that the stock will go up during the time they plan to hold onto the stock thus while I think it will decline someone else perceives for their reasons it will increase.

Considering you literally claimed Marx LVT as if it were gospel maybe consider you aren't going to have a good grasp on how stock markets work as that's not something you've studied.

A particular stock cannot be meaningfully considered overvalued if its entire value is speculative.

Such is the contradiction.

Perhaps you are not understanding speculation, confusing it with any investment purchase, any purchase based on expectation of rising value.

I have never said the entire value is speculative. I have said the price is based on perceived value of the company which us not 1:1 with productivity or actual reality in some cases (eg when the value is based on fraudulent information or reports a la Enron)

I observed as follows:

The following was your response:

It only confuses the matter further that you now offer as clarification, "I have never said the entire value is speculative".

I believe the observations I have given, more so than yours, are generally accurate.

The price of stocks is supported principally by the value generated by labor, with speculation necessarily only a secondary effect.

The belief that value will rise is generally an accurate belief, because growth occurs from the value generate by labor. Such growth is not related to speculation.

The bit you are overlooking is the conditional phrase "which is often not related to the productivity of workers".

If I suspect APPL is going to gain value because I know China is going to announce that Chinese government workers can use Apple devices, then the gain in value will be based on the speculation that the stock will rise with these potential new sales. Thus the rise is not related to anything the workers are currently doing only on what they might possibly do in the future. That is speculative.

The above is not the same as the total value being purely speculative. Stocks kind of sort of sometimes represent real valuations but they never reflect the pure value of the labor alone. If that was the case there would be nothing to speculate on. We know exactly how many units Apple manufactures and how many sell. That is factored into evaluations as to if the stock price is accurate or not.

The new sales would be of products whose creation occurs only through the labor of workers. Your are describing ordinary investment, not speculation.

The particular distinction is not relevant. Stocks gain value because of the labor of workers.

The labor of workers is the source of value, the single element without which stocks would never gain value. Speculation only occurs as secondary effect, a response to the intrinsic value generated by labor. If work stopped, if intrinsic value stopped growing, then speculation would also cease to have meaning.

An asset class inevitably crashes if traded speculatively but lacking any intrinsic value, as observed in Ponzi schemes.

The value increased because people suspect sales would be made of products that have yet to he created so the value increased with ZERO input from the workers.

"Stocks kind of sort of sometimes represent real valuations but they never reflect the pure value of the labor alone. The analysis is not relevant. Stocks gain value because of the labor of workers."

Sorry but it is entirely relevant as it demonstrates the inaccuracy if your claim that labor is the only source of value. It is not and you can easily find thousands of examples as to why the labor theory of value is no longer supported in neoclassical economics. Marx was wrong about this.

Speculation creates some of the value of stock and labor factors into it but neither accounts for the total value of the stock.

No prediction is absolute, and neither is any investment.

However, suppose inputs may be purchased at market for prices that are broadly stable, suppose a process is available for workers to create the products from such inputs, suppose the process is not in conflict with natural and legal constraints on the labor market, suppose the total wages required to pay to workers for each product is known, to reasonable precision, and suppose a consumer demand is also known, to reasonable precision.

Then, the prediction for profitability of investment is one related to general investment, not one based on speculation.

More, the prediction may be accurate only because the labor market exists, because workers will be available to provide labor.

If workers were not available, then no one would invest in production, obviously.

You have consistently misconstrued my claim.

I never asserted the value of an asset may never have a component that is speculative, only that an asset class cannot sustain a component of its value that is speculative unless it also has a component relating to intrinsic value.

Except in extreme cases, as noted, the reason assets have speculative value is because they also have intrinsic value.

Again, assets eventually crash if they have no intrinsic value, only speculative value. Such is the claim I have made, which you consistently misrepresent.

My guy/gal/bie, have you heard of GameStop?

Yes.

Have you heard of other publicly traded companies that are not Gamestop?

I am sorry, but your use of the one example to negate my position is sloppy and ridiculous.

So you're being purposefully obtuse. Wonderful. 🤦

No. I just have not made any claims that are negated by the events related to trading Gamestop.

Yes you have and I'll leave you to go research what happened to it so you can see the truth for yourself.

Or you can refuse and continue to embarrass yourself peddling lies. Your choice.

Which statement have I made that is a "lie"?

Ya know, workers can own stocks too. There's even companies that give stocks to employees. Stocks themselves are not the problem.

And what percentage of stocks are held by the working class?

As much as they wish. Also there's no working class, that's not 18th century anymore.

The working class is not defined in terms of historical dates.

The working class is everyone who lacks sufficient income to survive solely from owned assets such as businesses or rented properties.

Obviously, ability to purchase stocks is limited by wealth and income remaining after meeting other expenses.

Sorry, but the working class exists, and cannot own as much stock as it pleases.

A constructive response to the question would be of providing an actual percentage, as was asked, rather than returning an absurd deflection.

There are no classes in a capitalist system.

Ability to make investments is not limited by wealth, this is not a 19th century anymore.

Not sure which percentages you want.

Not enough, but that doesn't mean that stocks are the problem. The current system that allows billionaires to exist is the problem, not stocks themselves. Stocks could just as easily be used to fairly share ownership of a business amongst its workers.

Stocks themselves do allow billionaires to exist.

Almost always stocks is understood to represent tradable assets.

No dude.

You could get rid of stocks and replace them with a big book written in crayon that keeps track of what percentage of a company someone owns, but if you changed nothing else, billionaires would still exist.

It's the current financial and tax laws that allow billionaires to amass so much wealth, nothing else.

I am becoming confused about your overall position on the subject.

Nevertheless, it seems plain that as long as company shares remain tradable, some holders will accumulate fortunes allowing them to survive merely by virtue of their holdings, through profit generated by the work of others.

The trading of stocks itself, not particular laws or codes, supports the stratification of society into workers and owners, even if some workers own some stocks.

Yes, I agree with this, but plz realize that this is not solely dependent on stocks as people can, and do, amass wealth through other means. But it is definitely a big part of the problem.

Sometimes yes... and sometimes no!!!

As long as you choose to fixate on ONE thing, well... then you won't see the entirety of the picture.

Again, people CAN amass wealth without taking advantage of workers, or without trading stocks, and that is STILL a problem.

??? Where do you think the definition of stocks and the rules governing their trade exists? It absolutely IS particular laws that are the problem.

As I've said in other comments, you could get rid of stocks and replace them with some other set of rules for defining ownership, and guess what? If those totally new rules allow some people to a differentmass billions of dollars of wealth then we're back in the exact same situation... because it's the rules (ie: laws and codes) that are the fucking problem

Want to see a corrupt politician lose their mind? Tell them to increase the capital gains tax.

The meaning of your objections is difficult to understand, but it seems clear that you are not understanding the broader discussion.

Instead, it feels as you are spinning in narrow loops, trying to find problems with certain ideas, yet not realizing that such ideas are outside the scope of your loops.

Hopefully I can help, at least a bit.

No one has argued that eliminating stock trading is sufficient to address the problems in current systems, but surely at least as much is necessary, and the stock market is plainly a sensible target for antagonism, noticing that in it the most wealthy and powerful of society hold their wealth, and from it, derive their power.

All wealth gained in the stock market is profit gained by the work of others.

Depending on interpretation, the statement either is false on its merits, or too simplistic to be meaningful.

Property, and therefore wealth, is a social relationship, that is, occuring within social systems, whose structure transcends the choices of any participant.

Since no one endeavors to be deprived of wealth relative to another, everyone who has wealth relative to others has such position due to the surrounding social system having conferred structural disadvantages to others.

Therefore, being wealthy is nothing if not taking advantage of others and their disadvantages.

Any system, including the stock market, that confers vast advantages to some, is a rotten system.

My claim is not that trading stocks is not predicated on a set of governing rules. My claim is that every set of rules supporting the trade of stocks is broadly objectionable.

In other words, I object to your characterization that a single formulation of stock trading is problematic more than the practice at large.

Yes. Replacing a bad system with a slightly different system as bad or worse than the current is obviously not a thoughtful way address the current problems.

Perhaps try thinking harder.

If only there was a way to convert that stock into yachts... 🤔

Oh I'm not arguing against the absurdity of someone having a networth in the billions, I'm just trying to add clarity that it's the financial industry and tax laws that allow it to happen.

As opposed to just grunting "BILLIONAIRES BAAAAAAAAD!!!"

But it's true.

Being a billionaire automatically makes you a bad person. A good person would realize that they are neither entitled to have a billion dollars nor need it nor earned it. A good person would use that wealth to give back.

Your initial argument of land increasing in value is wrong in my opinion. Buying cheap land, seeing it increase in value and then selling it is either inside knowledge or pure luck. Plus you need the financial options to even start buying the cheap land. Money makes money, so rich people get more rich, just because they are rich. This works because humans exploit natural resources which are becoming more and more limited and give those resources a price, meaning those price will increase forever. Therefore control of these resources makes money, but not everyone has the chance of obtaining that control, thus making the entire system unfair and once again make billionaires bad.

I could continue this rant way longer, going on about how those billionaires then cause the majority of trash, emissions and use most resources, but this comment is long enough now.

You can only become a Billionaire by exploiting people and / or resources and not giving back to those you exploited. So fuck all billionaires. All.

The guy seems to agree with you on all of that and you're giving him shit because he's attempting to understand the problem and offer realistic solutions instead of screaming about it like a dipshit

Money only makes money if you choose to invest in things that increase in value.

If everybody invests in lithium mines then there will be a surplus and many investors will lose money.

It's work to collect the information to make the right choices.

Like workers don't share with the third world miners who provided the raw materials, billionaires don't share either. They can be taxed, though. But how much?

Should their billions be taken? Then who has the money to invest in risky opportunities? How much of their wages are workers willing to pool for those investments?

You are not adding clarity.

Your understanding is misguided.

Terse messages are used not because the broader messages lack substantive justification, but rather because repetition helps them gain enough attention that more of society will feel motivated to investigate and to reflect.